Help Session for Seniors, Disabled to Apply for NJ Property-Tax Relief

Sep 15, 2025

New Jersey Senator M. Teresa Ruiz, Assemblywomen Eliana Pintor Marin and Shanique Speight, alongside East Newark Mayor Dina Grillo and Harrison Mayor James Fife, will host a free assistance session to help residents 65 years or older, or those receiving Social Security disability benefits, complete the PAS-1 application. Filling out this form allows simultaneous application for three important state property tax relief programs: Senior Freeze (Property Tax Reimbursement), Stay NJ, and the ANCHOR (Affordable New Jersey Communities for Homeowners and Renters) program.

The event will take place at the Centro Romeu Casaces Portuguese American Community Center, located at 14 No. Frank E. Rodgers Blvd, Harrison, NJ, on Saturday, September 20, 2025, from 11 a.m. to 2 p.m. The deadline to submit the PAS-1 application is October 31, 2025. Attendees should bring a valid government-issued photo ID, their Social Security card, and a copy of their property tax bill (or lease information/rental agreement if applying under ANCHOR as a renter), as these documents contain the required information to complete the form.

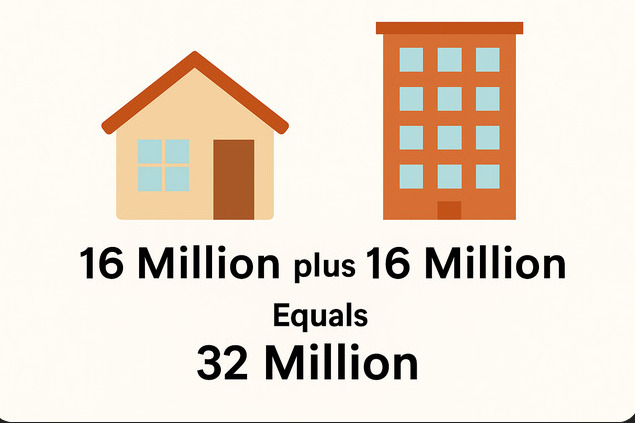

Despite the collection of 16 million dollars in PILOTs (Payments In Lieu of Taxes) by the Town of Harrison from the apartment buildings in the redevelopment zone, Harrison Mayor James Fife & Council are expected to raise property taxes once again. To put the $ 16 million into perspective, the rest of the homes in the Town of Harrison raise $ 16 million in property taxes. Therefore, Harrison Mayor James Fife & Council have double the money they had years ago, yet they have not provided property tax relief to property owners. Property Owners have, in turn, raised rents to offset the increase in property taxes. The property tax relief programs are important for both property owners and renters who qualify for the programs. Where has the additional 16 million dollars been spent? The money to pay for these programs comes from the State of New Jersey. In part, being paid by other residents in the form of high Income Taxes for individuals.

What Each Program Does, When It Started, and Who Qualifies

Below is an overview of the three programs: their history, what benefits they provide, and who is eligible.

ANCHOR (Affordable New Jersey Communities for Homeowners and Renters)

- Launch / History: ANCHOR was launched in 2022, replacing and expanding upon the previous Homestead Benefit program.

- What it provides: It offers direct relief/rebates to both homeowners and renters. The amounts depend on income, homeowner vs renter status, and age. For example, this season, homeowners earning up to $150,000 may receive up to $1,500; those in a higher income band (up to $250,000) receive less. Renters also receive benefits (e.g. $450) with a smaller cap. There is an additional bonus of $250 for applicants who are 65 or older.

- Eligibility requirements:

- Must be a New Jersey resident.

- Must own (and occupy) the home as the principal residence, or rent as their principal residence.

- For homeowners: the income threshold is higher (about $250,000) for 2024.

- For renters: income must be $150,000 or less.

- Must have residency/occupancy as of a certain date (e.g., October 1) of the year.

Senior Freeze (Property Tax Reimbursement)

- History: The Senior Freeze program has existed for many years (before ANCHOR) and was, for a long time, one of the major tools for helping seniors and disabled people offset rising property tax burdens. The exact origin predates 2020, but recent changes have modernized its income limits, filing forms, and deadlines.

- What it provides: It reimburses eligible seniors or disabled persons for increases in property taxes (or mobile home park site fees) on their principal residence. Essentially, once you establish a “base year” (the year from which increases are measured), the state will pay back the difference in property tax increases for subsequent years, if you meet the eligibility requirements for all intervening years.

- Eligibility requirements:

- Age 65 or older, or receiving Social Security disability benefits, by December 31 of the application year.

- Owner‐occupied primary residence (or owned mobile home park site) since a specified base date. Must have lived in the home and paid taxes (or fees) continually from the base year through the application year.

- Income limits apply. For example, in 2023 and 2024, the income limit is about $163,050 in an earlier year, rising slightly to $168,268.

Stay NJ Property Tax Relief Program

- Creation / When it starts: The Stay NJ Act was signed into law in November 2024 (P.L.2024, c.88) to establish a property tax credit program targeted at seniors and disabled persons. The benefit is scheduled to take effect starting in 2026, measured against property tax bills from earlier years (e.g. for tax year 2024).

- What it provides: Stay NJ will reimburse or credit eligible applicants for up to 50% of their property tax bill on their primary residence, with a maximum benefit cap of $6,500 for 2024. The exact amount you'll get depends on what relief you also receive under Senior Freeze and ANCHOR (i.e., those are subtracted or offset).

- Eligibility requirements:

- Applicants must be 65 or older or receiving Social Security disability benefits.

- Must have owned and occupied their primary residence for the full calendar year (e.g., 2024) in New Jersey.

- Gross income less than or equal to $500,000.

- Mobile homeowners (those who do not own the land on which their mobile home sits) are not eligible for Stay NJ.

How the Programs Interact & What the Combined PAS-1 Form Means

Under recent NJ law, and in particular through the Stay NJ statute and related State budget actions, the three programs are now accessed via a single combined application form, Form PAS-1. This one-stop approach is meant to simplify the process for applicants who might qualify for one or more of the reliefs. Even if someone only wants ANCHOR relief, those over 65 or on Social Security disability must use PAS-1.

One important constraint: the total benefit someone can receive under all three combined programs cannot exceed certain caps; in the case of Stay NJ, the cap is $6,500 (for 2024) after taking into account what was received via ANCHOR and Senior Freeze.

Why It Matters to Residents & Key Takeaways

- For many seniors and disabled persons, property tax bills (or related fees) are a major cost burden. These programs help reduce that burden.

- Renters are eligible under ANCHOR, which is significant because many relief programs are only for homeowners. This can help those whose rent is high in part because of property taxes embedded in rental costs.

- The bonus amount (e.g. $250 extra under ANCHOR for applicants 65+) means older residents can get somewhat more help.

📣 Tell us what you think on our Community Discussion Board. Not a member yet? Sign up today and be part of the conversation. It's a Free Membership.

Summary of Benefit Amounts (2025 / 2024 Tax Year Context)

|

Program |

Max or Typical Benefit for Homeowners |

Benefit for Renters |

|

ANCHOR (Homeowners) |

Up to $1,500 (lower amounts for higher income, e.g. $1,000 in certain bands). + $250 bonus if 65+ |

For renters: about $450, with $250 bonus if age 65+ |

|

Stay NJ (Homeowners) |

Up to 50% of the property tax bill, capped at $6,500 for 2024, after other reliefs from ANCHOR/Senior Freeze are applied. |

Stay NJ does not apply to renters under “Stay NJ” (it's only for homeowner residential property owners) |

|

Senior Freeze |

Varies by how much the property tax increases since the base year; for some recipients, reimbursements have been over $1,000 or more, and average around $200-$1,300 depending on prior year history. |

Not applicable (Senior Freeze is for homeowners or mobile home owners/leasers; renters aren’t eligible) |